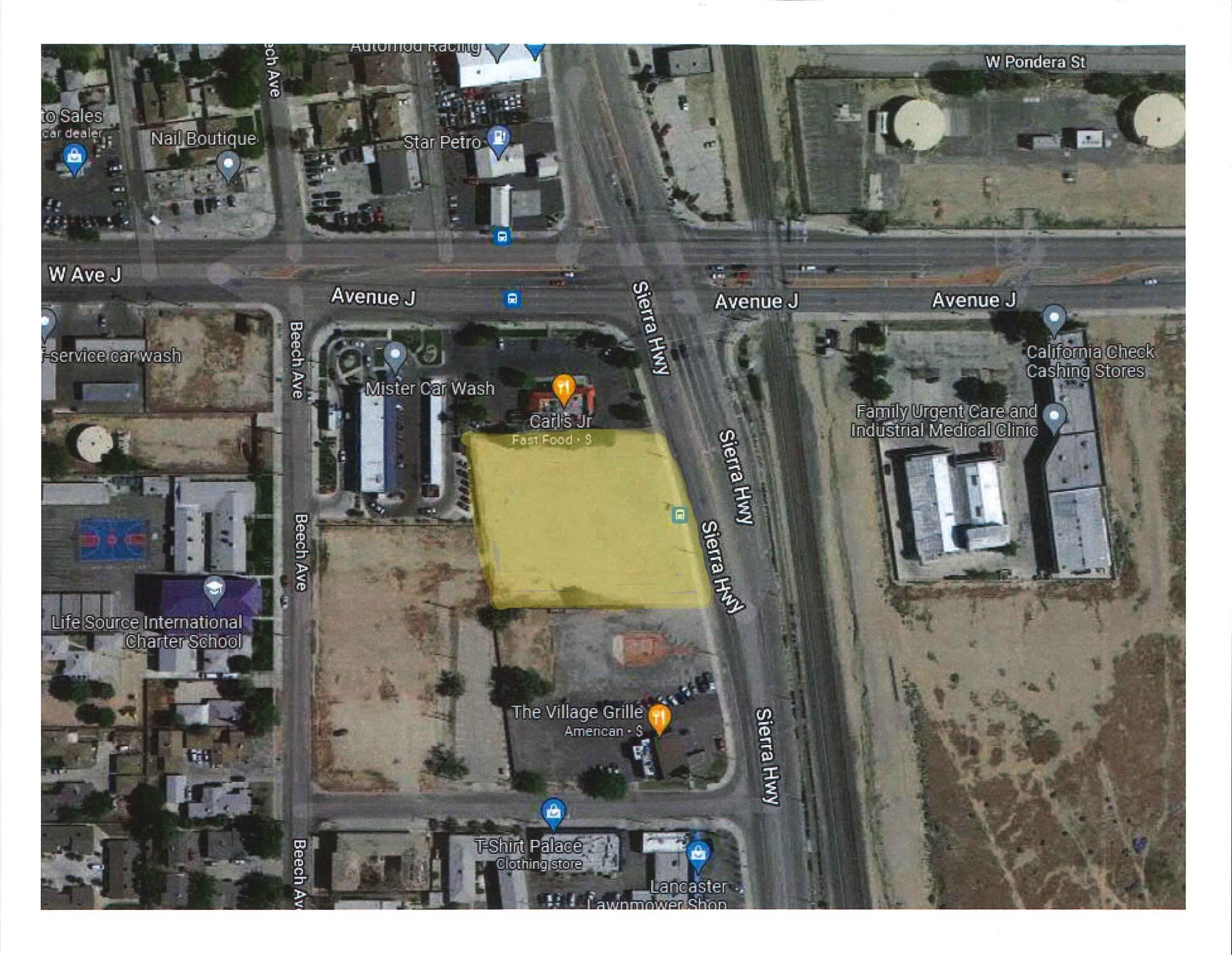

44431 Division Street

Lancaster, CA 93535

Active for $449,000

Beds: N/A Baths: Structure Size: N/A sqft Lot Size: 10,407 sqft

| MLS | 24004968 |

| Year Built | 1955 |

| Property Type | Mixed Use |

| County | Los Angeles |

| Status | Active |

| Active | $449,000 |

| Structure Size | N/A sqft |

| Lot Size | 10,407 sqft |

| Beds | N/A |

| Baths |

Description

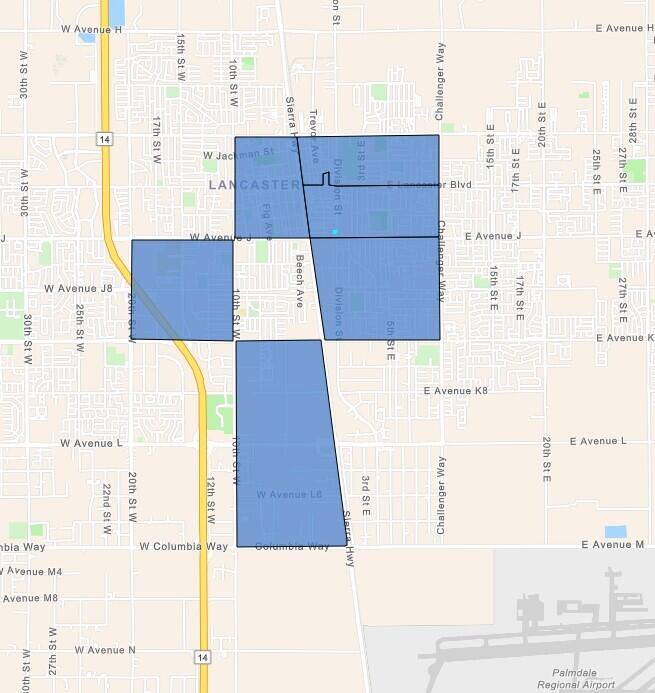

Commercial Building and Land For Sale. Currently operating as the White House Drive-In in Lancaster, CA. This Commercial Building and Land is located on Division St and Pondera St, just North of Avenue J, in Lancaster, CA. The current business, White House Drive In, has been happily serving customers of the Antelope Valley for almost 50 years. This commercial property is currently leased short term. Commercial property is located within one of the City of Lancaster, CA Opportunity Zone. This free standing Commercial Property has several commercial uses and could easily be modified for your own use. Some possible end uses could be converted into a drive-thru restaurant, drive-thru coffee shop, quick serve dairy, bar/tavern//cocktail lounge, retail store front, office space or many other end uses. You could put up a fence around the property and use the property for a variety of business ideas. Excellent corner lot with great visibility. Nice paved lot with ample parking on property and street. In December of 2017, a federal bill known as the Tax Cuts and Jobs Act of 2017 was passed. The new bill is designed to give investors new incentives to reduce and eliminate capital gain taxes. By doing so, it allows for an incredible tax break for investors through a new program known as Opportunity Zones. Through Opportunity Zones, investors will be allowed to defer their capital gain taxes, as well as a permanently excluding taxable income of capital gains from the sale or exchange of an investment in an Opportunity Fund. The purpose is to have investors reinvest their gains in Opportunity Zone funds. By doing so it will provide tax incentives (to low income areas), as well as temporary tax deferral on investors capital gains. In return, this money is used for qualifying census tract communities, also known as Opportunity Zones. These opportunity zones are designated in the vicinity of residential tracts where there are at least 30 businesses neighboring the sites. With the Tax Cuts and Jobs Act of 2017, It allows many benefits that Opportunity Zones have for Opportunity Fund Investors will defer, reduce, and eliminate the recognition of these capital gains through December 2026. Accordingly, they permanently avoid taxes on some capital gains when they invest those gains into opportunity funds. Overtime, if tax payers held these gains in opportunity funds after 5 years, then it would result in 10% of taxes being deferred and results in a 10% increase from the original gain. If the funds are held for 7 years, then it would increase by 5% ,resulting in 15% of taxes being deferred. If the investor were to hold these gains in opportunity funds for more than 10 years, then the taxes will essentially be eliminated on any additional capital gains. This bill allows for the government to pin-point census tract locations that qualify to be Opportunity Zones. The City of Lancaster has six qualifying locations with nearly 4,000 acres within Opportunity Zones, ranging from redevelopment opportunities to vacant land ripe for development and encompassing all zoning types.

Listing information courtesy of: Kris Chaisson, RE/MAX All-Pro 661-917-8205. *Based on information from the Association of REALTORS/Multiple Listing as of 04/04/2025 and/or other sources. Display of MLS data is deemed reliable but is not guaranteed accurate by the MLS. All data, including all measurements and calculations of area, is obtained from various sources and has not been, and will not be, verified by broker or MLS. All information should be independently reviewed and verified for accuracy. Properties may or may not be listed by the office/agent presenting the information.